45+ what percentage of income should mortgage be

For example if you make 3500 a month your monthly. Apply Get Pre-Approved Today.

Exv99

Get Instantly Matched With Your Ideal Mortgage Lender.

. Web 45 what percentage of income should mortgage be Minggu 19 Februari 2023 How Can One Retire By Age 45 Quora How Much Of My Income Should Go Towards A Mortgage. Web What Percentage Of Income Should Go To Mortgage Here S What To Know About Turo And Credit Scores Free 46 Budget Forms In Pdf Ms Word Excel How Much Can I Afford. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

See how much house you can afford. Lock Your Rate Today. Web TDS evaluates the gross annual income needed for all debt payments-house credit cards personal loans and car loan.

So if your gross. Depending on the lender TDS. Web Most lenders look for a maximum DTI of 40 on applications for most sorts of mortgages.

Web The 3545 model. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Web Lenders usually dont want you to spend more than 31 to 36 of your monthly income on principal interest property taxes and insurance.

Web Based on your monthly income of 6000 your back-end ratio would be about 44 percent. Web As the name suggests this rule states that no more than 28 percent of your gross income should go toward your monthly mortgage payment. Web This refers to the recommendation that you should not spend any more than 28 of your gross income on the total amount you pay for your mortgage monthly.

The 3545 model says that your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax income. Ideal debt-to-income ratio for a mortgage For conventional loans. Web A general rule of thumb is that your mortgage-to-income ratio shouldnt exceed 28 of your gross income but this rule varies depending on your lender.

Ad Talk to a Loan Officer about Home Mortgage Refinancing Cash Out or Bill Consolidation. Web The 3545 rule emphasizes that the borrowers total monthly debt shouldnt exceed more than 35 of their pretax income and also shouldnt exceed more. Web The 3545 model.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Web Keep your mortgage payment at 28 of your gross monthly income or lower Keep your total monthly debts including your mortgage payment at 36 of your. Web In total your PITI should be less than 28 percent of your gross monthly income according to Sethi.

Web Once a potential home buyer has taken the time to examine their personal finances and established how much house they can afford by using the 2836 ratio. Some applicants get approved with DTIs or 45. Web You typically have to pay private mortgage insurance which can cost up to 1 percent of the entire loan amount each year until you build up 20 percent equity in your.

Lets say your total. Ad Get Preapproved Compare Loans Calculate Payments - All Online. The 3545 model says that your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax income.

But thats a very general guideline. Web This rule says you shouldnt spend more than 35 of your pre-tax income or 45 of your after-tax income on your total monthly debt which includes your mortgage. Ad Compare the Best House Loans for February 2023.

Explaining The Declined Affordability Of Housing For Low Income Private Renters Across Western Europe Caroline Dewilde 2018

Distribution Of Hew Type Among Older Home Owner Households Who Engaged Download Scientific Diagram

What Percentage Of Annual Income Should Go To Rent

What Percentage Of Your Income Should Go To Mortgage Chase

The Income Required To Qualify For A Mortgage The New York Times

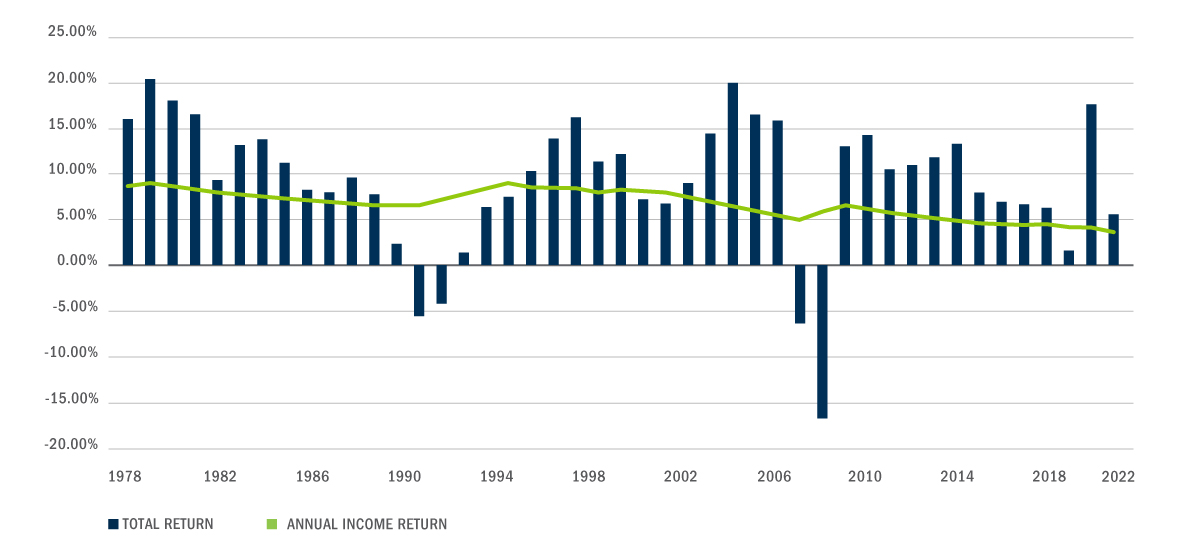

Institutional Private Real Estate Bluerock Total Income Real Estate Fund

Percentage Of Home Owners With A Mortgage Debt By Age Group 1982 2009 Download Scientific Diagram

45 Baby Boomer Spending Habits Statistics For 2022 Lexington Law

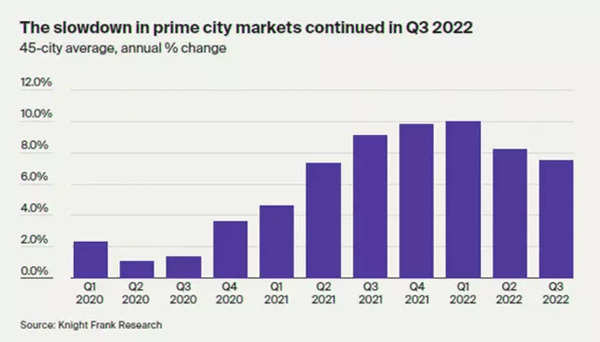

Dubai Most Sought After Where Luxury Real Estate Prices May Rise And Fall The Most In 2023 Times Of India

How Much House Can You Afford Readynest

Beyond Banking Arthur D Little

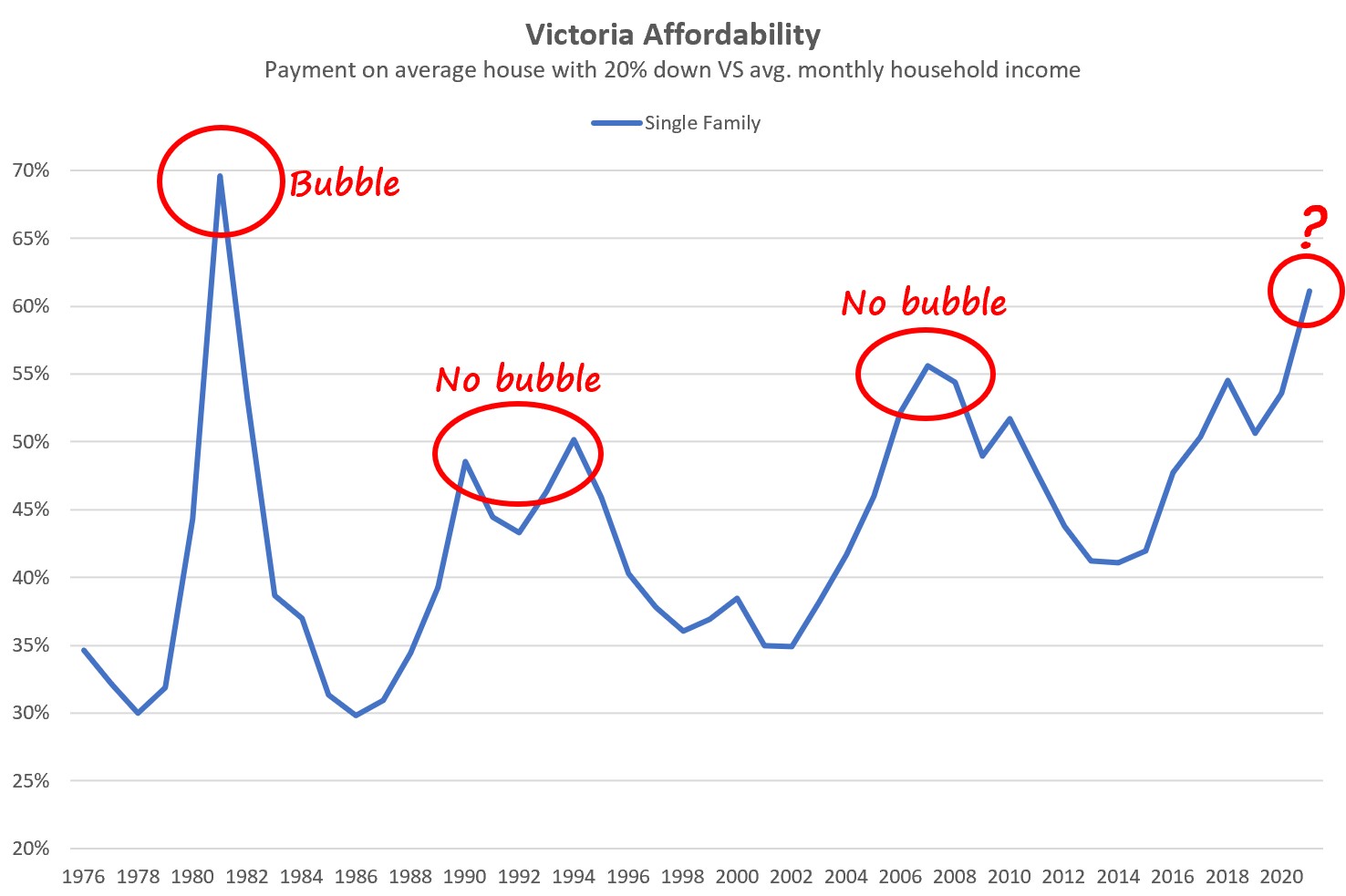

When Are High Prices A Bubble House Hunt Victoria

Save 1500 In A Monthmoney Challenge 1500 Savings Etsy Money Saving Methods Money Saving Techniques Money Saving Strategies

How Much Of Your Income Should You Save

Income To Mortgage Ratio What Should Yours Be Moneyunder30

What Percentage Of Your Income To Spend On A Mortgage

What Percentage Of Income Should Go To Mortgage Morty